The July class title was ‘How to create your own government supported energy project.’

The subjects to be covered were the 179D tax rebate, rebates for Combined Heat and Power (CHP), and a look at residential heat pumps.

When I wrote the class content, I figured I would be well on my way to my own 179D rebate.

Three discoveries:

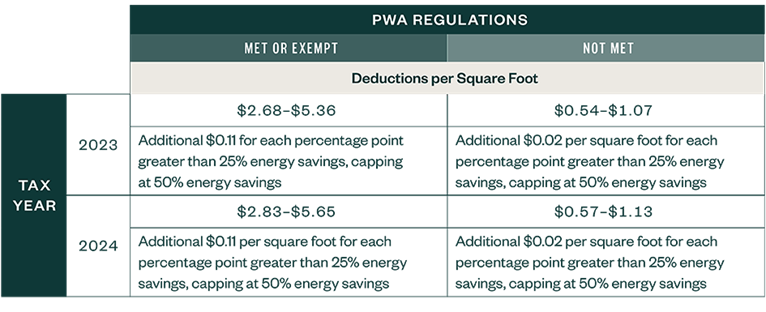

- The 179D tax credit is for building efficiency.

I investigated replacing our HVAC system and windows in conjunction with the 179D credit. Our building is 54000 square feet, so a $270k downstroke on a project sounds good to me.

I was under the impression that, to achieve 50% energy savings, I’d need to employ an energy engineer and a high performing HVAC system.

Turns out, to apply for and receive this credit, you need an accounting company more than you need an energy company. No commercial blower door testing, no energy model, and not necessarily a high-performance HVAC system.

What do bean counters know about 50% reduction in energy? Probably not nearly as much as the rest of us, but apparently the exercise is getting the application through the process.

I may still do a 179D application after I replace our windows, but it doesn’t seem like HVAC is the driver in this case, according to the accountants I spoke to.

Too bad.

- 30% Federal Tax Credit for Combined Heat and Power

I’ve presented Combined Heat and Power (CHP) and Gas Powered VRF on a few occasions, seen some interest, but no real opportunities coming around. (At least not with Air Flow.) My takeaway is that companies that are looking to decarbonize do not see using gas with CHP as a solution, and companies that don’t want to decarbonize don’t seem to have the desire to solve a problem they don’t have. On the gas powered VRF, it’s an amazing solution for the right sized project, but I don’t want to get started on a project with R410A.

There are still opportunities where CHP makes sense. I put on a training last year on this subject, check it out here.

- Residential Heat Pump Market

My heat pump install went fine and got the rebates I was expecting. $1300 (now $1000) from Focus on Energy and a $2000 tax credit on my federal tax return. After the 45,000 views of my heat pump installation on YouTube, I figured folks would be banging down the doors. Customers still rely on their residential contractor for a proposal, and those guys like to stick with their brands.

Just remember, to get the federal tax credit and the Focus on Energy rebate, your dual fuel heat pump needs to have an AHRI listing (heat pump + coil or heat pump + furnace + coil) and have a COP of 1.75 at 5F. We’ve got that in 2-,3-,4- and 5-ton systems. Here’s Air Flow’s heat pump flyer for reference.

Summary

Sorry to change courses on y’all. I was looking forward to putting this content together and realized, especially with 179D, that a different expert would be required to teach the class.

As usual, I learned different things than I expected.

See you in (the next) class.

All the best,

Tom Gelin

Air Flow, Inc.

8355 West Bradley Road Milwaukee, WI 53223

414-351-1999